Contact +27 10 021 0239 ✉︎

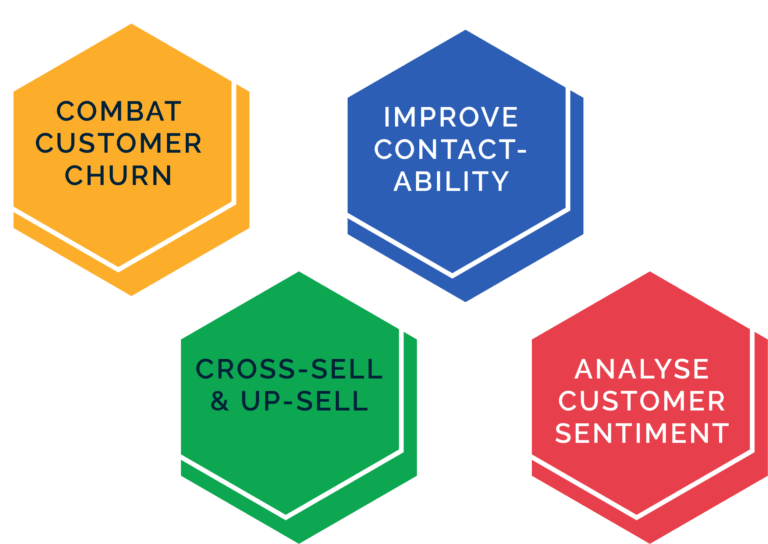

CROH is our proprietary multi-module solution that helps organisations and businesses achieve up to a 33% boost in revenue from their existing customers, a 30% reduction in customer attrition, and up to a 38% increase in customer reach. Find out how we can help you.

More often than not, customer attrition is tantamount to revenue loss. Lost transactional fees, lost interest income, lost premium and lost sales represent a few of several ways in which revenue is lost when a customer discontinues doing business with your organisation. Moreover, studies have shown that the cost of acquiring a new customer is much higher than the cost of maintaining an existing customer. In light of this, it is important to curb customer churn and increase customer retention to run a sustainable and flourishing business.

Through numerous engagements with our clients, we (Analytics Hive) established that their previous interventions to retain Clients typically came too late – when the customer has already decided to discontinue doing business with their organisations. That typically renders retention strategies, no matter how well crafted, fruitless. The development of a Customer Attrition Predictive Model helps to proactively identify customers with high propensity to churn. By doing so, you enable business Decision-Makers to engage customers in a timely manner thereby diminishing likelihood to churn.

Triggered by frequently expressed burning need to retain clients, Analytics Hive developed YoursTruly – an easily customizable solution to combat customer churn. Implementing YoursTrulywill capacitate your organisation to answer the following questions at any given point in time:

The ability to reliably answer these questions will empower your Organisation to detect early warning signs up to 12 months prior to churn and enable you to proactively engage customers whose risk to churn is high. Consequently, it allows you to drive appropriate retention strategies thereby diminishing your competition’s leverage to cannibalize your client base.

Given that nothing happens until someone sells something — be it a product or service – the customer represents an important Stakeholder pivotal to the success of any business. The ability to keep abreast with, and reliably anticipate, customer requirements and sentiment enables a business to exploit new opportunities and mitigate risks. Consequently, you can drive sustainable revenue growth whilst curbing client attrition. In the wake of omni-channel customer contact strategies fuelled by increasing digitization, how does a business ensure that customers are contacted in the most optimal way when need arises? Additionally, how does your organization keep these contact strategies cost efficient, select the appropriate channels, and ensure accurate data?

Analytics Hive has developed an easily customizable and highly flexible Customer Contact-ability Solution (CCS) to help our clients improve customer reach. Our clients have reported significant quantifiable improvements in several use cases as explained below.

Whether it is collection of insurance premium, repayments on a lending product, or instalments towards a purchased retail product – the Customer Contact-Ability solution helps.

Our clients have reported improvements of up-to 30% in successfully reaching non-compliant clients whose payments were in various cycles behind contractual terms. Recovery rates improved significantly owing to the ability to reach previously hard-to-reach

Whilst grossly-underreported to protect Organizational Reputation, fraud continues to plague organizations and in some cases gets aggravated by consequential litigation when clients lose funds due to fraud.

Our solution promotes quicker detection of anomalies and curbing fraud when validating transactions, for example.

Given that there are costs associated with running campaigns, it is in the best interest of businesses to maximize conversion rates where targeted clients sign-up to take on suggested offerings.

Our solution enables increased reach and greater precision when engaging target clients during campaigns leading to greater conversion and higher return on investment in campaigns.

Repeat business represents an important dimension of sustainable revenue growth. Our clients report improvements in renewal of products including Credit Cards and other financial products. The ability to proactively reach a customer and encourage renewal of near-term products reduces the risk of customers switching and makes it harder for competitors to cannibalize your organization’s business.

Timely delivery of renewed products to the correct addresses enhances customer satisfaction and loyalty.

Analytics Hive will assess your environment and tackle priority areas where value can be demonstrated without breaking the bank and within attractive turnaround times.

Are you getting 100% out of your existing customer base? Instead of looking for new leads and customers, you need to optimise how your organisation generates revenue from its existing customer base. With the Cross- and Up-sell solutions from Analytics Hive, you can boost income from existing customers by as much as 33%! By analyzing your customer data, we can identify new opportunities and allow you to convert those opportunities into deals.

Contact us today to find out how we can use Cross- and Up-sell Solutions to help you generate more revenue from your existing customer base.

At Analytics Hive, we’re continually working to develop new and advanced solutions to help you, our client, find new ways to utilize your client data. With a Customer Sentiment Analysis, you can stay attuned with both the polarity and degree of customer sentiment to proactively manage potentially adverse narratives and evangelize positive aspects of your service and/or product offering.

Contact us today to find out how we can use Customer Sentiment Analysis to help you gain actionable insights from your client data.

Contact

Primary Address

Company

Resources

© Copyright 2023 Analytics Hive. All Rights Reserved. Our website is compliant with POPI Act. Read our privacy policy.